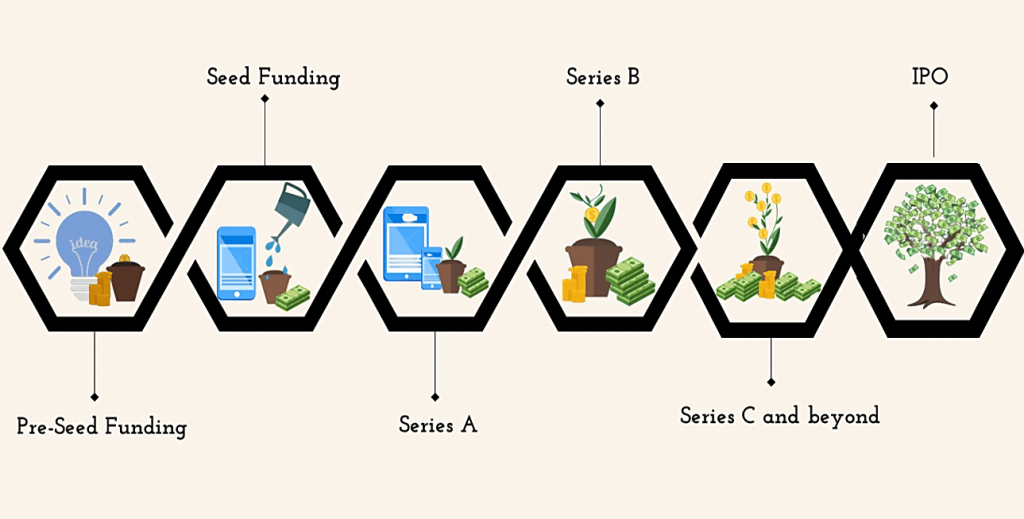

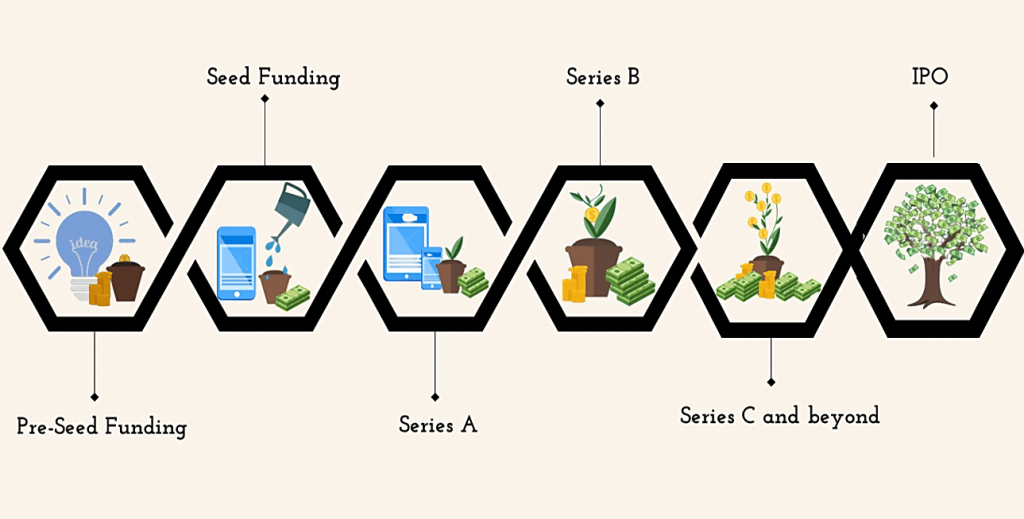

Startups typically go through several stages of funding as they grow and develop. Here’s a general breakdown:

- Pre-Seed Funding: In the early stages, many entrepreneurs fund their startups themselves, using personal savings or loans or seeking small investments from friends and family.

- Seed Funding: Seed funding is typically the first official equity funding stage. It usually takes the form of a convertible note or, less commonly, preferred stock. Seed funding is used to support market research and product development, and often comes from angel investors or early-stage venture capital firms.

- Series A: Once the startup has a track record of success (a developed product, growing user base, consistent revenue), it may seek Series A funding. This is typically used to optimize the product and user base. Series A funding often comes from venture capital firms, including those that specialize in early-stage funding.

- Series B: Series B funding is used to scale the company, increasing production and expanding into new markets. By this stage, the startup should have a substantial user base and consistent revenue. Series B funding often comes from venture capital firms, including those that specialize in later-stage funding.

- Series C and Beyond: Series C funding is used to scale the company even further, often to prepare for an acquisition or IPO. By this stage, the startup is usually successful and profitable. Series C funding often comes from private equity firms, hedge funds, and banks.

- IPO: An initial public offering (IPO) is when a company’s shares are sold to the public for the first time. This is a way to raise a large amount of capital, but it also comes with increased scrutiny and regulatory requirements.

Remember, not all startups will go through all of these stages, and the lines between stages can be blurry. The funding needs and opportunities for each startup will depend on many factors, including the industry, market conditions, and the startup’s specific business model and strategy.